Credit cards have been one of the most misunderstood financial products in the Indian market. While some people completely ignore its use, thinking that they will end up in debt, others act carelessly, buying things using it and treat it as an extension of their bank balance. These two extremes may seem different, but they share a common root cause, which is a lack of understanding of the credit card concept.

Credit cards is not inherently risky, nor is it a financial shortcut. It is a regulated credit instrument that works strictly according to predefined rules. When used with clarity and discipline, it can be a useful financial tool. When used without understanding, it can become expensive very quickly.

This article explains what a credit cards really are, how it works behind the scenes, and how Indian users should approach it in a practical, informed way.

What Is a Credit Card?

A credit card is a short-term revolving credit facility granted by a bank or an NBFC. Essentially, when you use it, you are not using the funds from your own pocket. You are taking a loan from the bank that issued your card, on the condition of paying it back later with the agreed terms.

In India, the credit card industry is under the supervision of the Reserve Bank of India (RBI). The RBI lays down the guidelines for billing cycles, interest disclosure, fees, penalties, and consumer protection. This regulatory framework classifies credit cards as formal loan products rather than mere payment instruments.

The most important thing to understand is this: A credit card is a payment deferral tool, not a payment waiver one. Also, whether or not that deferral will cost you, and how much, is totally up to how you handle the repayment.

Common Misunderstandings Around Credit Cards in India

Many issues with credit cards stem from mistaken assumptions rather than poor intentions. One of the misconceptions is that credit cards give free money that can be used without any consequences as long as the payments are delayed. What is actually the case is that credit cards provide borrowing facilities on terms. If the total amount is paid back before the due date, no interest will be charged.

Another incorrect thought is that credit cards are inherently harmful and risky. The danger does not lie in the product itself but in the behaviour that leads to the use of the product such as overspending, neglecting billing cycles, or making only minimum payments. Early comprehension of these mechanisms makes it less likely that one will get into debt.

Who Is Involved in a Credit Card Transaction?

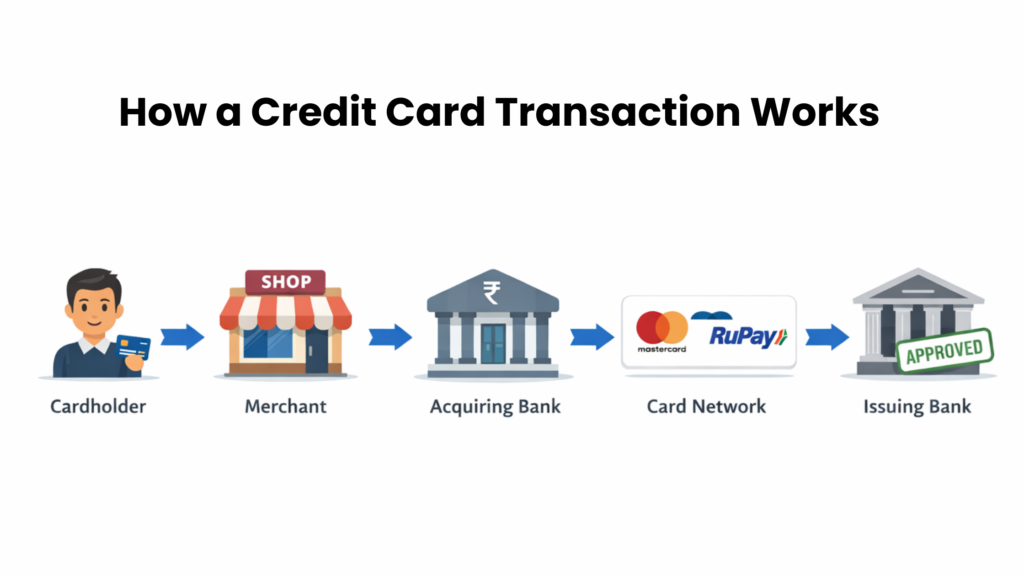

Although a credit card transaction feels instant, multiple parties are involved in every swipe or tap. These are the cardholder, the merchant, the issuing bank, and the card network (like Visa, Mastercard, or RuPay). The card network facilitates secure communication between banks, while the issuing bank evaluates whether the transaction should be approved.

This multi-layered structure has been put in place to ensure that the facilities of security, fraud detection, and settlement are up to standard. For the user, this means that his credit limit and risk profile are taken into consideration. Each transaction is checked almost immediately and thus each transaction is evaluated in real time.

What Happens When You Use a Credit Card?

In a typical credit card transaction, the merchant first forwards the payment request to the acquiring bank. Then through the card network, this payment request is sent to your issuing bank. Your issuing bank checks if you have enough available credit and if the transaction is legitimate.

If approved, the issuing bank immediately pays the merchant. Your transaction amount is then added to your outstanding balance. Up to this point, no cash has been taken out of the savings account. You have become the bank’s debtor for the exact amount, and this will be shown on your next statement.

This is exactly what the credit card is all about: a delayed repayment method.

Understanding the Credit Limit

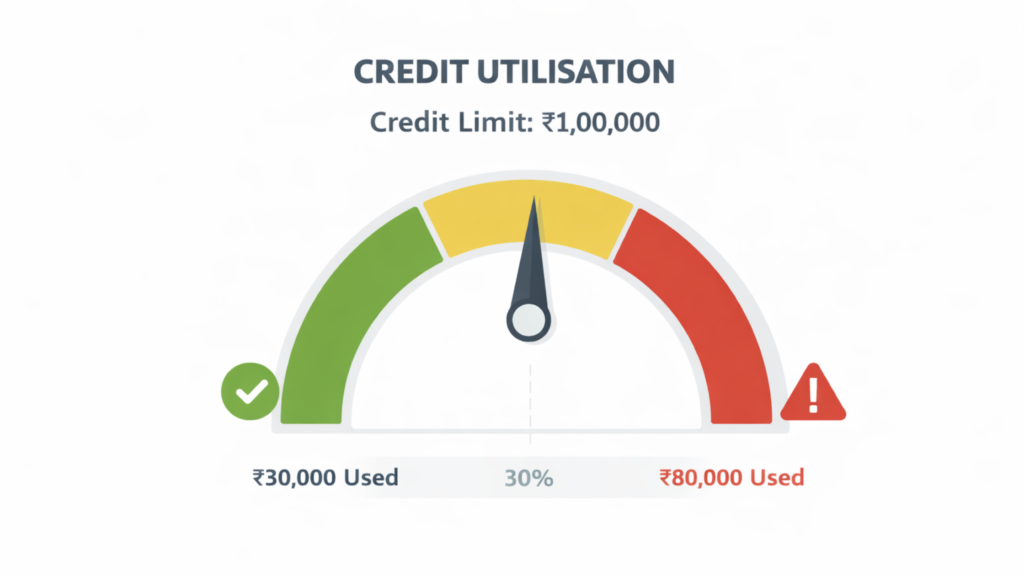

The credit limit is essentially the maximum amount the bank is willing to lend money to you at any given time. This is determined by looking into various factors such as your income, credit score, existing loans, and your past repayment behaviour.

A higher credit limit doesn’t mean you have higher spending capacity. It reflects the bank’s assessment of lending risk, rather than the level of your financial comfort. In terms of financial health, most experts agree that it is best to keep credit card spending under 30% of the total credit limit. Increasing your utilisation also raises your interest exposure and could lead to a drop in your credit scores.

Billing Cycle, Statement Date and Due Date

Credit card repayment policy follows a fixed structure that users must be aware of and understand it clearly.

The billing cycle is the period in which transactions are recorded, and it usually lasts between 28 to 31 days. At the end of this cycle, the bank produces a statement indicating the total amount due. This is referred to as the statement date.

The bank then gives a payment window, usually 15 to 20 days after the statement is generated, which is called the due date. If the full amount on the statement is settled by this date, no interest is incurred.

As a result of this arrangement, purchases made at the beginning of the billing cycle can, in fact, be granted a 45-50-day interest-free credit period. This is one of the major advantages of credit cards, but that is only when the payment discipline is observed.

How Interest Is Charged

Generally, credit card interest rates in India are relatively higher, commonly ranging between 24% to 48% per annum. Credit cards are unsecured credit products. Since banks do not take collateral, interest rates are significantly higher compared to secured loans such as home loans or vehicle loans. Besides, interest is computed daily on a reducing balance basis instead of monthly.

If you do not pay the full statement amount by the due date, interest will be charged on the unpaid balance from the next day onwards. Even if you make a partial payment, interest will still be charged on the amount that was not paid.

Minimum Amount Due

Banks give cardholders the option of paying the minimum amount due, which is typically about 5% of the current outstanding balance. Hence, paying this amount would save the customer from late payment penalty but would not stop interest from the remaining balance from being charged.

To illustrate, in case the total bill is 40,000 and the payment of only 2,000 is made, interest will be calculated on the balance of 38,000. Eventually, this will result in a lengthy cycle of revolving debt.

Fees and Charges Associated with Credit Cards

Besides interest, credit cards have a variety of fees that users need to know. Some of these include annual or renewal fees, late payment fees, cash withdrawal charges, foreign currency markup fees, and GST on the charges that are applicable.

Banks are required to disclose these under the Most Important Terms and Conditions (MITC) document. Reviewing this document before using a card extensively helps avoid unexpected costs.

Credit Card vs Debit Card

The functional difference between credit and debit cards is often misunderstood. The table below summarises the key distinctions.

| Feature | Credit Card | Debit Card |

| Source of funds | Bank’s money | Your bank balance |

| Interest | Applicable if unpaid | Not applicable |

| Credit score impact | Yes | No |

| Fraud protection | Stronger | Limited |

| Rewards | Cashback, points | Minimal |

Debit cards are suitable for strict expense control, while credit cards are better suited for building credit history, managing short-term cash flow, and handling larger or online transactions.

Impact of Credit Cards on Credit Score

A credit card is a very powerful tool that can greatly influence a user’s CIBIL score. On the positive side, the score gets a lift when a user makes payments on time, has a low credit utilisation ratio, and keeps the account for a long time. But it can go down if one makes late payments, has a high utilisation ratio, takes cash frequently, and applies for several cards within a short period.

For a person with no or very limited credit history, a credit card that is very well managed may be the best way for him to build a strong credit profile.

RBI banking data indicates that credit card outstanding balances in India have been steadily increasing over recent years. While this reflects growing adoption and digital spending, it also suggests rising exposure to revolving credit.

Common Credit Card Mistakes in India

Some of the typical issues that have been noticed among credit card users in India are: treating the credit limit as if it was disposable income, not taking into account the billing cycles, only paying the minimum amount required, over using EMIs for unnecessary expenses, and not checking monthly statements.

These are problems that credit cards themselves do not cause, and which are to be blamed on the users not understanding the credit card structure and related costs well enough.

A credit card may not be suitable for individuals who struggle with repayment discipline, already carry high-interest debt, or do not have predictable monthly income. In such cases, debit-based spending is generally safer and reduces financial stress.

Practical Risk Assessment

| Area | Works in Your Favour When | Becomes Risky When |

| Interest | Full payment on time | Partial payment |

| Credit Score | Low utilisation | High utilisation |

| Cash Flow | Planned spending | Impulsive spending |

| Rewards | Regular expenses | Lifestyle inflation |

Final Perspective

A credit card is neither a financial solution nor a financial problem by default. The real cost of a credit card is not the annual fee, it is the interest triggered by behavioural mistakes. It is a structured lending instrument that reflects how responsibly borrowed money is managed.

If one uses a credit card carefully, for example, by always paying the full amount on time, keeping the utilisation low, and also being aware of the fees, then the card can help in credit building as well as in cash-flow management. On the other hand, if used recklessly, it is only going to be a costly burden.

Before one can consider using a credit card on a regular basis, there is one question that is more important than any feature or reward:

Are you using the card intentionally or simply out of habit?

This answer will determine if a credit card is a tool for strengthening your financial position or if it is just one of the factors that weaken your financial position.