Are you annoyed of seeing your savings balance barely growing in bank account? While habit of saving is very essential, yet it’s not enough to build considerable wealth in long term. Here comes the power of investment comes into play. By investing, you can convert it into wealth-generating machine with power of compounding working in your favour in long term.

Investing is more than just saving your money; it is about how you make your hard-earned money work for you over the time with wise decisions. Investments help achieve future dreams like retirement, a major purchase, or securing other things, while making it possible to realize your financial goals quicker than on any other method. But where should one begin, and what does it mean to invest wisely? Let’s explore how you can harness the power of investment to achieve financial independence.

What Is Investment? Understanding the Power of Investment

Investment is act of allocating your money into assets or ventures with the hope that it will appreciate or become more worth or generate regular income in future. It is not just saving money in your bank account, because unlike your savings at your bank, when you invest, you have an increased risk but there is potential to earn higher returns. This risk-reward relationship is integral part of investment, which differentiates it from savings. Investment is an essential for both personal and professional growth. In short, instead of keeping your money just sit there, you make it work for you.

Why You Should Invest: Key Benefits of Investing Your Money

Many people wonder is investing necessary, especially when one already have savings. However, savings alone can’t help you to build wealth due to inflation. Over the period, the purchasing power of saved money decreases, which means that your money could be worth less in the future than what it is today. By investing, you have opportunity to beat inflation and grow your wealth. When you truly understand the power of investment, you unlock opportunities that saving alone can never offer.

Here are 6 key reasons why investment is crucial:

Magic of Compounding: Investments made in assets such as bonds, stocks or mutual funds etc. have the potential to grow over a period time. What happens here is, your invested money starts to earn money on its own. Imagine planting a sapling, initially it’s small. But as you keep nurturing, it grows into a tree and gives you fruits. The more you nurture, more fruits it produces. Likewise, your money also grows exponentially over time due to the magic of compounding. This is what the ‘Power of Investment’ is. You keep earning interest on interest and on the principal amount.

Inflation Protection: Cost of goods & services tends to rise over the time eroding the purchasing power of money. In simple terms, inflation means that you will be able to buy less with same amount money in the future than you can today. Investment returns have historically outpaced inflation rates.

Income Generation: Investing some assets like dividend-paying stocks or rental properties, will provide you a regular cashflow along with the potential for value appreciation.

Wealth Creation: In long run the power of investing can multiply your initial capital and help you grow wealth passively, provide financial freedom and security for long term goals.

Financial Goals: Whether it’s to buy a house, save for children education, or plan for retirement, investments can help you achieve long-term financial goals more effectively than simply saving.

Financial Independence: An appropriate investment strategy can help in achieving financial independence where the investments made are able to generate the returns which can manage your living expenses.

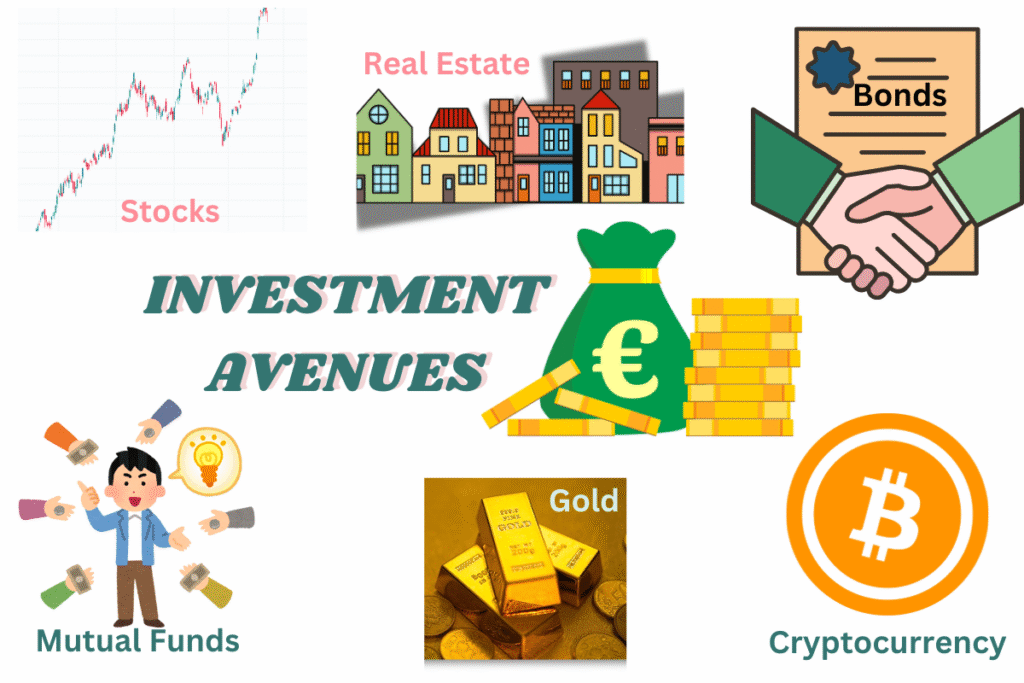

Top 5 Types of Investment Options for Beginners

In today’s market, there are many options to select from when it comes to creating your financial security, such as stocks and bonds, real estate, mutual funds, or other government-backed security instruments. With every investment category comes various risk or reward outcomes. Before you jump into investing, you must thoroughly evaluate all of your investing options. Then, reflect to yourself which option is congruent with your financial future and make investment decision to realise the power of investment. Choosing the right combination of these investments enables you to fully unlock the power of investment, the ability to grow your money exponentially and build lasting wealth.

Stocks: Buying company stocks means you own a small part of that company. While stocks can make you the most money, they also carry the biggest risk. You could lose all or a lot of your cash if the company goes under or doesn’t do well.

Bonds: In comparison to stocks, bonds are generally less risker. When buying a bond, one is essentially trusting the government or a corporate with his or her money. The interest is a token of appreciation for the sum borrowed which the borrower pays back after some time.

Real estate: Investing money into property (real estate) often gives good return in the long run. It can bring in steady rental income and appreciate as time passes. As a tangible asset, real estate, it is often view as a hedge against inflation. This makes it both safe and likely to grow even when the market is shaky.

Mutual Funds and Exchange Traded Funds: This offers investors to pool their money together to create a pooled investment option that is generally managed by a professional investment manager, in which you are able to diversify your investments, which lowers your risk. This is a preferred option to explore for a new investor interested in diversifying portfolio than investing directly and managing your investments.

Cryptocurrencies: These are relatively newer and adventurous options. Investing in cryptocurrencies such as Bitcoin or Ethereum offers the tantalizing high-value, but risk is extremely high as well. Therefore, it is a high, yet risky option for investors to explore, which entices the idea of high investment return, but is uncertainty in the market.

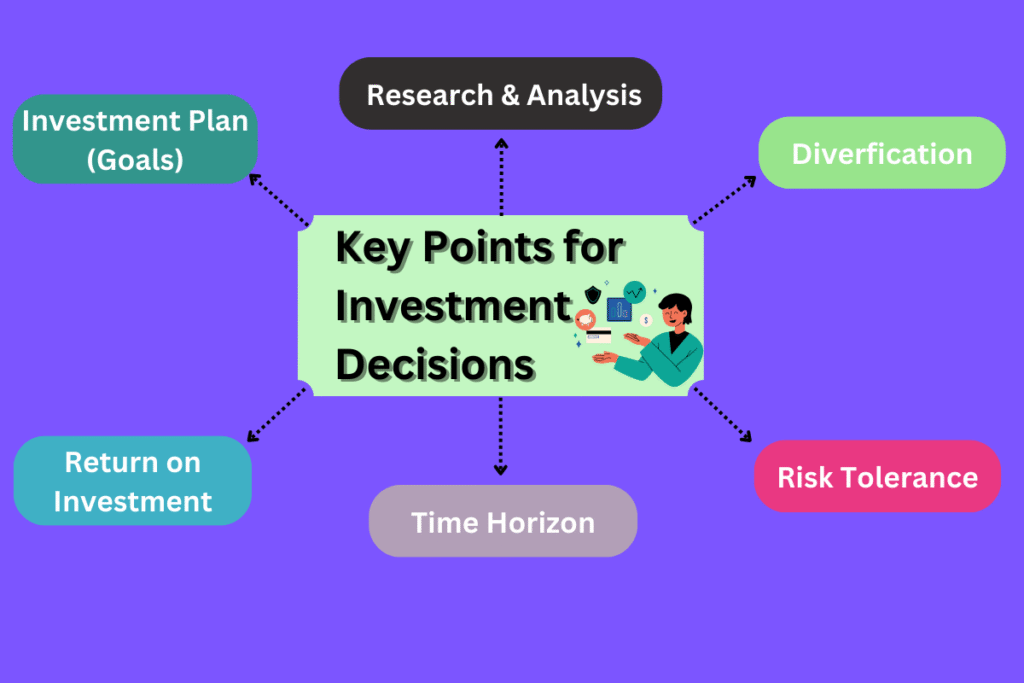

Key Points to Consider Before You Begin Investing

Each and every investment has a certain level of risk-reward ratio associated with it. Generally speaking, riskier investments have a potential for higher returns, while investments with a lower risk will have potential smaller returns. It’s always best to consider exactly how much risk you’re comfortable with prior to discovering any investments. Risk tolerance of an individual depends on factors, such as age, financial goal, and even your timeframe for a particular investment.

Risk Tolerance: The fact is that all investments are typically associated with some risk. Prior to investing in anything, assess the amount of risk you will tolerate and then plan your investment strategy. Investments that will have a higher return, also, are typically higher in risk, while safer investments will have a protected smaller return.

Time Horizon: As ‘rule of thumb’, your investment decisions should match with your financial goals to unveil the power of investing. If you are investing for your retirement funds, you’ll be looking long-term and it will be far easier to ignore any bumps up or down based on day-to-day changes in the stock market, however short- investment goals will require a more conservative strategy for placing your investments.

Diversification: Investing all your money in one asset class is very dangerous, commonly referred to as: ‘don’t put all your eggs into one basket’. Diversification allows individuals to mitigate risk and lower his or her losses by investing into different categories. A well-diversified portfolio safeguards your investment during market downturn by balancing high risk invest with safer options.

Research and Education: The overall outcome of your investment, i.e. power of investment, is completely based on your decisions. Therefore, it is essential to put some efforts to do research, analyse the markets, investment types to learn market fundamentals better. Stay updated on the responsiveness of the economy daily and you will become more knowledgeable about what and why are developing markets trends.

Sticking to Your Investment Plan: Consistency in investment is very essential. It is the nature of market to fluctuate, but it is important to be firm to realize the power of investment and not let your emotion overpower your logic. Focus on long term gain instead of panicking during short term dip in market to recognize the power of investment.

Costs and fees: Be mindful of all transaction fees, management fees and any other cost that reduce your investment’s return. Opting for cost-effective options like index funds allows you to retain more of the benefits that come with the power of investment.

The Role of Financial Planning in Successful Investing

Financial planning acts as a roadmap to your investment journey. It helps align your income, expenses, savings, and goals so you can make informed and confident decisions. It provides the foundation for effective investing and allows you to fully harness the power of investment over time. A strong financial plan helps you:

- Set short-, medium-, and long-term goals.

- Create a realistic budget and track expenses.

- Build an emergency fund before investing.

- Prioritize goals like retirement, home purchase, or children’s education.

- Align investments with personal values, timeframes, and risk profiles.

A solid financial plan ensures that you’re not investing randomly, but rather as part of a clear, goal-driven strategy.

How to Get Started with Investment

There is no doubt that putting money in smart investments is one of the best options that can be used to not only increase the wealth you have but also endeavours to safeguard the future wealth. For those who are ready to go on this journey, the following is a guide in steps on how to go about it.

Determine Investment Targets: The initial and fundamental component of any investment program is setting a clear goal. Define the purpose for which you are going to invest and the amount needed to attain these purposes. This involves a subdivision into short-terms and long-terms goals. If the goals are very clear, then it helps in making out the investment planning structured.

Build an Emergency Fund: Make sure that one of the priorities for the first few months is that before making any investments make sure that you had set up an emergency fund. Emergency fund is usually defined as up to where one need not work for or earn, usually 3-6 months of sustaining expenses in case something goes wrong. This serves as a shield against potential calamities and helps one to be at ease.

Selecting Investment Platform: In the current day, since there is a wide range of platforms that can be used for investment, deciding on the right one becomes a tedious activity. Examine the platforms based on charges, level of friendliness, investment options offered, and customer support. Have an understanding of the possible investment options available and the appropriate one that best meets them.

Start Small: Begin with a small amount of money and gradually increase it as you become more confident and experienced. Starting small helps you learn without taking big risks. To unveil the power of investment, one important thing is to start early, staying in the market for a long duration usually works better than trying to guess the best time to invest. As you gain more experience, you can change how much you invest and how you invest it.

Review and Rebalance: Over time, both the market and your personal situation will change. Regularly checking and adjusting your investment portfolio ensures it stays in line with your financial goals and how much risk you’re willing to take. This process involves adjusting your portfolio to maintain your desired asset allocation, which can help you manage risk and optimize returns.

Consider Professional Advice: If you are beginner and/or have a complicated financial scenario, then do not hesitate to approach for advice from financial advisor. An expert can guide you through the landscape and provide you strategies to suit your individual investment needs.

Common Investment Mistakes to Avoid

Failing to Diversify: Putting all your money in one place can become very risky. A diversified portfolio is always recommended to mitigate the risk as well as to ensure steady growth through the power of investment.

Timing the Market: Trying to predict and catch market’s up and downs movements always leads to poor investment decisions. Instead stay focused on your timeline and trust the power of investment to deliver results over the long run rather than timing or predicting the market moves.

Ignoring Fees and Costs: Expenses such as management fees, brokerage, taxes can significantly affect your overall returns. Be cautious about these costs while making the investment decisions.

Conclusion: The Long-Term Power of Investment

Investing is not exclusive to the rich; it is a way for everyone to turn their savings into wealth and improve financial well-being going forward. In order to be a successful investor and reap fruit from power of Investment, one requires patience, discipline and a well-defined financial planning strategy (the ability to make smart decisions not driven by emotions). Knowing your investment choices, knowing how much risk you can take and having the courage to stick with long-term goals will allow investments work for you in life. So, remember: wake up early, and allow your future-self to enjoy the compounded returns of baby-steps taken today.

FAQ

Save or Invest -What is the difference?

You save when you put some money away for future use, usually at a bank and you invest by buying assets that are expected to increase over time in value.

How Much Money I need to start Investing?

Depending on the type of investment, you are able to start investing with as little as 500. There are also platforms that will let you invest without committing to a fixed amount.

Can I invest if I have debt?

Yes, you can still invest with debt but I would recommend tackling your high-interest debts first.

Want Safest Investment Options?

Government bonds, high-interest savings accounts and some real estate.