When we think about investing or building wealth, a lot of complicated charts come into our mind. One might imagine long hours of market research or experts with years of financial knowledge. But the truth is very simple and clear. Wealth is not built over night, it is built step by step, like laying bricks in a house, and one of the strongest bricks is ‘mutual fund’.

It is often called “the democracy of investing” since mutual funds unite people in investing, allowing them to pool their resources to create wealth, irrespective of their background, knowledge, or expertise. Compare it with planting a tree: You could just scatter a bag of seeds in the hope of something coming up, or you nurture the seedlings one by one across the seasons. This is exactly what mutual funds represent: consistent effort, disciplined, and rewarding.

For beginners, it acts like the first bridge into the giant world of finance, while for experienced players, they are tools of diversification and stability. Therefore, Mutual Fund is not just an investing tool, but it is a way to practice purpose driven financial planning.

What are Mutual Funds:

Mutual Funds is an investment instruments that invests in diversified pools of securities such as equity, bonds, and other money market instruments by pooling funds or money from numerous individuals like you and me. It is managed by a professional fund manager, who makes investment decision based on strategies and objective of Fund on behalf of investors. With this, instead of putting all your money in just one company or stock, you have a piece of a diversified portfolio. In return, investors are given units of mutual funds representing their share of ownership.

How do Mutual Funds work?

Mutual funds work by pooling investors’ money in a diversified portfolios of equity, bonds or other money markets instruments. The fund manager is at the core. His job is simple in principle but complicated in practice: to select investments that are in line with the fund objective, make changes in holdings as and when market conditions change, and try to maximise returns on investment. All decisions are researched-backed, driven by market tendencies, and the experience of trained professionals.

The performance of the fund relies on the securities it holds, if they increase in value, investment grows and this reflects in the unit price (Net Asset Value or NAV) increases and investors earn profits. If they depreciate, so will the value of the fund.

Mutual funds broadly fall into two categories: actively managed and passively managed. In actively managed funds, there is an important role for the fund manager, researching markets, examining data, and selectively choosing investments in hopes of earning superior returns. Such funds are heavily dependent upon skill and extensive research.

On the other hand, passively managed funds, commonly known as index funds which simply mirror a market benchmark such as the Nifty 50 or the Sensex. Since they only track an index, they demand little intervention, making them more cost-effective and easier to manage.

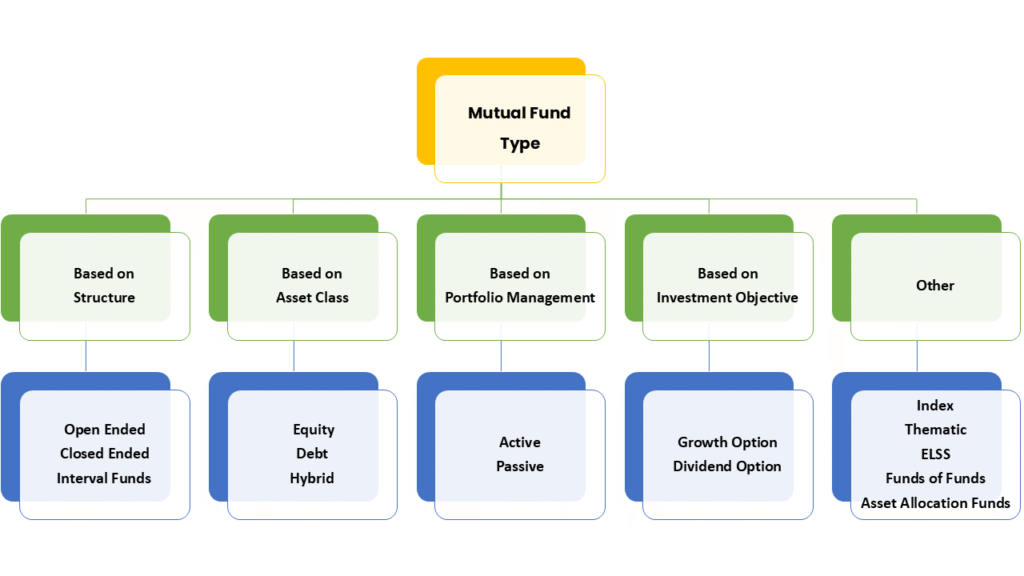

Types of Mutual Funds

Before you start, it is important to know the different types of mutual funds. Each one serves a different purpose, much like tools in a toolbox.

Equity Mutual Funds

Equity funds are invested primarily in company stocks or shares focussing on capital appreciation. They are most suited to long-term goals like retirement, buying a house, or funding the child’s education. Since they are linked to the stock market, they are risky but can give higher returns.

Large-cap funds: Invest in big, stable companies. Like sturdy old trees in a forest, less shaky, more reliable.

Mid-cap funds: Invest in medium-sized companies. Consider them to be budding saplings, capable of growing higher in a shorter duration than the large trees.

Small-cap funds: Invest in small but budding companies. Risky it is, but if properly looked after, they can sprout like wild plants.

Debt Mutual Funds

Debt funds purchase bonds, government securities, or fixed-income securities. They are less risky and less volatile than equity funds. Ideal for investors who want steady, predictable income with less risk. Think of debt funds like the slow-and-steady driver who keeps to the slow lane but does reach the end safely.

Hybrid Mutual Funds

As the name suggests, the funds combine both equity and debt. The risk and reward are equal so it accommodates people who want the ultimate in everything. It’s adventure and security simultaneously, half roller coaster, half smooth sailing.

Index Funds

Index funds merely replicate a stock market index such as the Nifty 50 or the Sensex. Rather than attempting to outperform the market, they go in the same direction. Consider it like going along the current in a river instead of rowing upstream. Index funds are affordable and are suitable for new investors.

ELSS (Equity Linked Savings Scheme)

If saving taxes excites you, ELSS funds should be on your radar. They not only give you equity exposure but also tax benefits under Section 80C. The catch? They come with a three-year lock-in period. But if your goal is wealth-building, three years is hardly a long wait.

Sector or Thematic Funds

They are geared towards particular sectors such as technology, health care, or energy. High risk, high reward. Think about investing in one horse in the race, you can win huge but you can also lose huge. Such funds are appropriate for experienced investors.

Benefits of Investment in Mutual Funds

Why do so many people prefer mutual funds over other investment options? Here’s why:

Professional Management

Not everyone has the time or experience to track the stock market day to day. Experts do it for you in the field of mutual funds. Experts research, track, and rebalance so you won’t have to concern yourself with each shift in the market.

Diversification

“Don’t put all your eggs in one basket.” That old piece of advice serves as the foundation for the existence of mutual funds. By investing in dozens or even hundreds of securities, they diversify. Even if one stock does poorly, others can make up for it.

Liquidity

Mutual funds are unlike fixed deposits or property in the sense that you can buy and sell easily. Require liquidity? You can redeem your units instantly (apart from ELSS issues). It’s having a saving that works harder but can be accessed at the same time.

Flexibility

Want to invest in a lump sum? You can. Like to make small, periodic payments? SIPs are there for you. Mutual funds accommodate your financial conditions instead of imposing fixed plans.

Tax Efficiency

Some funds, such as ELSS, help you save on tax. Even in other categories, their long-term capital gains tax is favourable over the short-term one.

Affordability

You don’t need lakhs to get started. Even with ₹500 or ₹1000 a month you can start investing. Over time, with compounding, these small amounts can grow into large sums.

Modes of Investing in Mutual Funds

Generally, there two methods of investing in Mutual Funds:-

Lump Sum Investment

Conceptualize lump sum investment as sowing one large tree at one time. You have one large sum of money and invest that directly into the market at one time. If the scenario is favourable, this strategy has the potential of growing rapidly and yielding excellent returns. The best-suited individuals are the ones that have extra money coming in and they feel positive that the market stands on their side. But there is a catch, as the whole sum goes in at once, the result depends largely on how the market performs. If it oscillates, so does your money. High reward but with greater risk.

Systematic Investment Plan (SIP)

Now, picture yourself growing a garden one seed at a time. That’s what SIP is all about. Rather than making one large chunk, you distribute your money into frequent, small payments, monthly, quarterly. As time goes by, your steady payments become substantial. The advantage of SIP is that of consistency. It minimizes the stress of guessing the “perfect time” of investment, and it insulates you from the fluctuations of the market. Furthermore, while markets are down, your money purchases more units, which help you out in the long term.

How to Begin with Mutual Funds

Initiating your mutual fund journey may feel overwhelming, however the reality is getting started is easier than you imagine. The perfect time to invest was yesterday, but the second-best time is today. Here’s how you can begin:

Define Your Purpose

Question yourself: Why am I investing? Is it retirement, your kids education, your dream home or just freedom? This clarity on your “why” provides more than direction, it also helps you select the appropriate fund type.

Know Your Risk Appetite

Each investor has a distinct comfort level.

If you’re comfortable with volatility for superior returns, equity funds may be ideal.

And if you lean toward safety and stability, debt funds could seem cozier.

And if you’re looking for a mix of both, hybrid funds may be the middle ground.

Imagine it as the difference between cruising in smooth seas, surfing small swells or going after bigger, more lucrative storms.

Begin Small with SIPs

You don’t have to accumulate a big lump sum amount to start investing in Mutual Funds. Begin with what you have. SIPs let you invest a consistent amount each month, like filling a jar with a drop, it does not feel heavy, but one day you see look back and it’s full.

Choose the Right Fund & Platform

Not all the funds are same. Contrast them on critical variables such as historical returns, expense ratio, and fund manager experience. Keep in mind, historical returns are no promise of future performance, but they’re instructive.

You can invest via banks, online apps, or directly with AMCs platform. Choosing a platform that you find easy to use and that keeps investment tracking simple is essential.

Stay Consistent and Patience

Mutual funds aren’t a get rich quick scheme, instead it is a long-term game. Consider them as planting a tree, you nourish it, and over a time it rewards you with shade and fruits. Markets will rise and fall but patience and discipline are what transforms modest inputs into enduring wealth.

Barriers That Hold People Back

- If mutual funds are so beneficial, why doesn’t everyone invest? It is because of their fears and misconceptions.

- Fear of Risk: Many investors are under the impression they are “gambling” when investing in mutual funds. But in reality, risk depends on the type of fund you invest in and for how long you stay invested.

- Lack of Review: Your goals may evolve over time. Review your portfolio once every year and make sure that it is aligned with your requirements and if necessary, make necessary changes.

- Poor Past Experience: Maybe you have lost money because you invested at the wrong time or in the wrong product. As they say, mistakes are teachers, not obstacles.

- Procrastination: Waiting for the “perfect time” to start is like waiting for all traffic lights to turn green at once, it never happens.

Common Mistakes to Avoid

- Chasing Short-Term Gains: Don’t switch between funds just because the one you have invested in, has underperformed for a few months. Stay focused on your long-term goals.

- Ignoring Costs: High expense ratios, means higher costs for managing the fund, which can eat your returns. Always check these costs before investing.

- Lack of Review: Your goals may evolve over time. Review your portfolio annually to ensure it aligns with your needs and if needed make adjustments.

- Not Starting Early: Time is one’s best friend. The earlier you start, the more compounding effect works in your favour.

Conclusion:

Mutual funds serve as one of the most convenient gateways to investing, making it possible for individuals to participate in financial growth without needing to master every detail of the stock market. But do not consider it as quick scheme, instead it is a long-term game. What they do promise is steady, reliable growth if you stay committed. They turn ordinary savers into investors, and investors into wealth-builders.

By pooling resources from multiple investors, and investing in diverse securities, these funds offer diversification, expert management, and accessibility for people having different financial goals. Whether your goal is wealth creation, building a steady income stream, or setting up a financial safety net, mutual funds offer a reliable and adaptable platform to achieve your goals. With options designed for varying levels of risks and timeframes, they help to simplify the complexity of financial planning and empower you to take confident steps toward a secure future. The sooner you begin, the sooner you can unlock the potential of mutual funds in shaping your financial journey.