Introduction

In today’s fast-paced, digitally driven world where financial choices are more complicated than ever before, financial literacy is an essential life skill. Whether you are a student paying tuition fees, a young professional balancing household and savings commitments, or a parent saving for your children’s education, financial literacy helps you to be confident and make sound decisions about your finances. The importance of financial literacy cannot be overstated, as it is the foundation for achieving financial independence and overall financial well-being.

While it’s so important, yet many are not in possession of the information and competencies to deal with their cash efficiently. Financial literacy is more than being aware of how to save or how to balance a budget. It’s learning how cash works and making good decisions that give you financial security and independence. When you live in a world that is crisscrossed with credit cards, loans, online purchasing, and investment opportunities, being financially literate is no longer a choice; it’s a necessity.

Let’s explore what financial literacy is, how important it is, in both short and long term, the risks of financial illiteracy, and how you can begin enhancing your financial expertise right now.

Table of Contents

Understanding Financial Literacy

Financial literacy refers to the knowledge and capacity to make sound and effective choices regarding personal financial management. It encompasses the knowledge of financial topics such as budgeting & saving, investing, credit, debt, and retirement planning.

In essence, financial literacy empowers you to:

- Establish a realistic budget

- Understand interest rates and credit scores

- Manage financial crises

- Make sound investment choices

- Stay out of debt traps and scams

- Save for large life costs and for retirement

Financial literacy is more than a skill—it’s an empowering force that contributes to your overall financial well-being.

Unfortunately, despite its importance, financial literacy levels are low worldwide. Only 33% of adults across the world are financially literate, a survey by the Global Financial Literacy Excellence Center (GFLEC) reported.

Why Financial Literacy Is Important in Daily Life

You do not have to be an investment expert or finance guru to reap the benefits of financial literacy. It is important for your day-to-day life and can significantly enhance your lifestyle.

Budgeting and Expense Management

One of the basic advantages of financial literacy is learning how to budget. By monitoring income and managing spending, you are in charge of your finances. You have a clear picture of where your money is going and may be aware of where you are overspending. Individuals who are financially literate are more likely to be living within their means and to be free from excessive debt. Developing strong budgeting skills is crucial for effective financial decision-making.

Responsible Use of Credit

Credit cards, loans, and instalment plans are something that can be used to your advantage or your detriment. By knowing how interest, credit scores, and payments work, you can make smart decisions, stay out of high-interest debt, and keep your credit record healthy. A good credit score can affect how loan applications are approved, who you’ll be hired by, and if you’ll be approved to live in an apartment.

Saving for the Unexpected

Financial literacy educates on the need for an emergency fund, a cushion that can absorb unexpected expenditures such as medical bills, car trouble, or loss of a job. Lacking savings, a small emergency can result in severe financial crisis. Understanding various saving strategies can help you build this crucial safety net.

Reducing Stress and Promoting Peace of Mind

One of the leading causes of depression and anxiety is being worried about money. When you are secure and prepared regarding your finances, you feel more confident and secure. Financial literacy can give you a sense of peace of mind that you are on target to meet your financial goals, you have an emergency plan to rely on, and you are moving toward a secure future. That sense of peace is priceless.

Protection from Scams and Fraud

Scams are more advanced now. A financially aware person is better placed to identify and shun fraudulent deals, protecting themselves from huge losses. During an era of phishing emails, spurious investment plans, and internet cons, financial awareness is your best protection. It assists you to identify warning signals and avoid being a victim of fraud. This aspect of financial literacy is closely tied to consumer protection, which is essential in today’s complex financial landscape.

The Long-Term Effects of Financial Knowledge

Financial literacy not just relates to day-to-day living but also the planning of a better tomorrow. Good planning starts with good finance education. Having the ability to budget, save, and invest wisely allows individuals to make good decisions that contribute towards fulfilling their financial goals, with long-term security and less financial worry.

Retirement Planning

Many people delay retirement planning owing to a lack of knowledge about where to start. Financial literacy provides the means of getting educated about retirement saving methods (like EPF, PPF, Retirement plan), projecting the cost of the future expenses and utilizing the power of compound interest for growing the wealth over the years. Understanding various insurance products is also crucial for comprehensive retirement planning.

Investment Know-How

Smart investing is the secret to creating long-term wealth. Financial awareness enables you make informed decisions on the different investment opportunities including stocks, mutual funds, bonds, property, ETFs and evaluate the possible risks and gains. Learn how to diversify the portfolio, avoid speculative traps and stick by the longer-term objectives. This knowledge is essential for effective risk management in your financial portfolio.

Achieving Life Goals

Whether purchasing a house or a car, world travel or financing college for kids, for every aspiration there exists a financial aspect. With a clear understanding of personal finance, you will be able to plan wisely and attain these dreams without anxiety. Setting and achieving financial goals is a key component of financial wellness.

Breaking Generational Patterns

One of the greatest benefits of personal finance education is that it doesn’t just stop at yourself. When you understand finances, you’re likely to pass that on to children, friends, and community. It becomes a ripple. Financially literate parents raise financially literate children, and over time this fills the wealth gaps and makes more stable and resilient communities. This transfer of knowledge contributes to broader economic literacy and can even foster entrepreneurship skills in future generations.

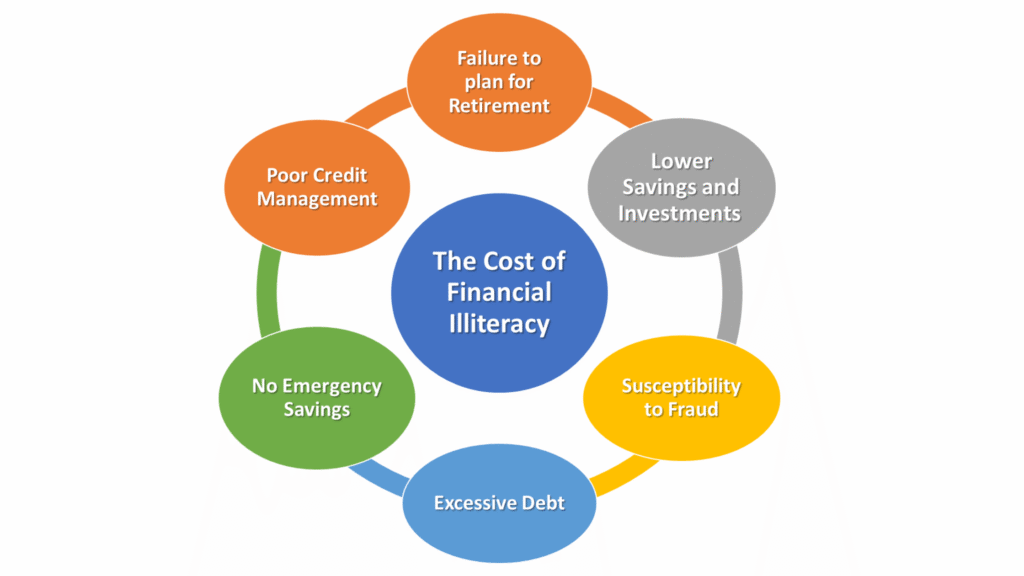

The Cost of Financial Illiteracy

Unfortunately, most individuals are not aware of the fundamentals of money management. According to surveys by the Global Financial Literacy Excellence Center (GFLEC), almost two-thirds of global adults lack proficiency when it comes to finance. These have serious implications:

Excessive debt: Without recognizing the workings of interest rates or the terms of payments, most individuals get caught up in debt cycles that are hard to escape.

No Emergency Savings: Many families are unable to cope even with a small surprise expense without resorting to borrowing funds and subjecting themselves to the additional strain.

Poor credit management: Lack of credit knowledge results in negative credit scores as well as higher loan costs.

Failure to plan for retirement: Numerous individuals arrive at their retirement years without adequate saving as they never knew how or when they should plan. This includes a lack of understanding about retirement-focused insurance products and tax implications.

Susceptibility to Fraud: If you don’t know about finances, it’s very simple to get deceived by scams and dangerous pyramid schemes that will drain the very funds you are saving. This underscores the importance of consumer protection education as part of financial literacy.

Financial illiteracy harms not just individuals but families, communities, and even the economy as a whole. The good news is that, through the right education, these cycles of illiteracy can be broken and a more robust and secure future can be built for everyone, contributing to overall financial stability and economic growth.

Enhancing Financial Literacy: The Starting Point

The good news is that the ability of being financially literate is something you can develop at any time of point during your life. Here are some strategies to enhance your financial literacy:

Reading and Research

Begin by reading easy-to-understand personal finance books like:

- Rich Dad Poor Dad by Robert Kiyosaki

- The Psychology of Money by Morgan Housel

- The Total Money Makeover by Dave Ramsey

You could also subscribe to finance blogs, YouTube channels, and podcasts for regular insights. These financial resources can provide valuable financial education and help you develop financial responsibility.

Utilize Budgeting Apps and Tools

These include apps like Mint, YNAB (You Need A Budget), Goodbudget, or PocketGuard that enable you to monitor expenses, make goals, and develop better financial habits. These tools can significantly improve your budgeting skills.

Consult a Professional

A certified financial planner (CFP) will provide you with a personalized plan based on your earnings, objectives, and risk level. They can offer guidance on investing, insurance, and taxes, tailored to your specific situation.

Enroll in Online Courses

Virtual platforms such as Udemy, Coursera, and edX provide affordable courses on investments, debt management, and financial planning. These courses can be particularly beneficial for those seeking financial literacy for students.

Begin Small and Persist

Even small steps, like tracking expenses for a week or setting a monthly savings goal can create momentum. Consistency is more important than perfection when it comes to achieving your financial goals.

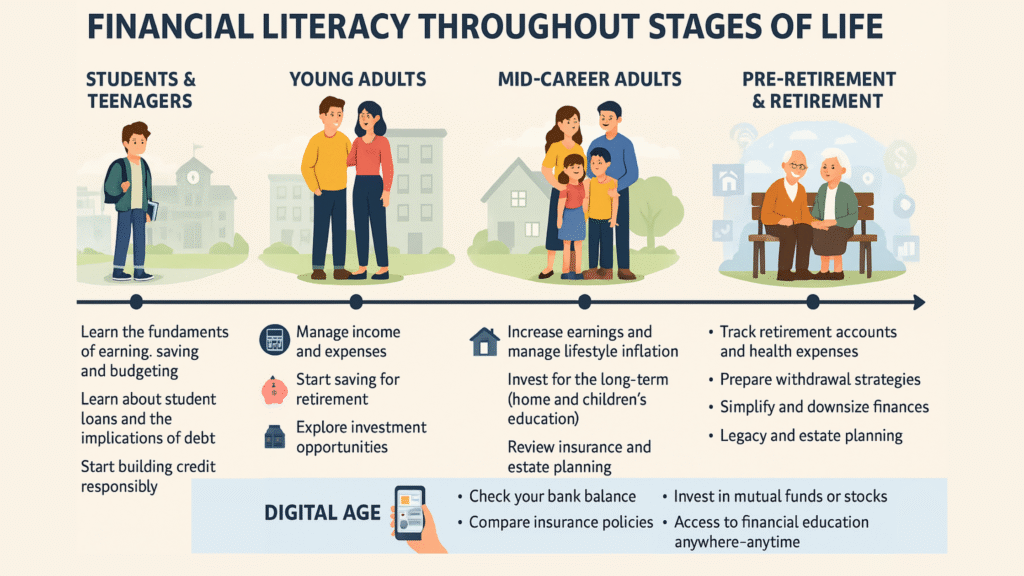

Financial Literacy Throughout Stages of Life

Your finances evolve as do your needs. The following shows how financial literacy comes into play at various stages of life:

Students and Teenagers

- Learn the fundamentals of earning, saving, and budgeting

- Learn about student loans and the implications of debt

- Start building credit responsibly

- Understand basic tax concepts

Young Adults

- Manage income and expenses

- Start saving for retirement

- Explore investing opportunities

- Build a credit history

- Learn about various insurance products

Mid-Career Adults

- Increase earnings and manage lifestyle inflation

- Invest for the long-term (home and children’s education)

- Review insurance and estate planning

- Explore entrepreneurship opportunities

Pre-Retirement and Retirement

- Track retirement accounts and health expenses

- Prepare withdrawal strategies

- Simplify and downsize finances

- There should be legacy and estate planning

- Understand insurance needs for this life stage

Financial Literacy During the Digital Age

Technology has revolutionized finance. With just a smartphone, you can:

- Check your bank balance

- Invest in Mutual funds or stocks

- Compare insurance policies

- Access to financial education anywhere-anytime

But with such tools comes bigger obligations. Online financial literacy is necessary for comprehending online transactions, keeping your information private, and making informed digital spending decisions. It’s crucial to understand the role of financial institutions in this digital landscape and be aware of various financial products available online.

Conclusion: Financial Strength through Knowledge

Being financially literate isn’t a buzzword, it’s the foundation for a secure and fulfilling life. It enables you to make smart choices, sidestep money pitfalls, and pursue your aspirations confidently. Financial literacy is the key to financial empowerment and long-term financial well-being.

Whether you’re getting your very first paycheck or are saving for retirement, it’s never too early or too late to be smart about your finances. By improving your financial literacy, you’re not only securing your own future but also contributing to broader economic growth and stability.

Start today. Grab a book, sign up for a class, or make a first-ever budget. Every small step is a brick towards a day when you’re the one calling the shots on the money—not the reverse. Remember, financial literacy is a journey, not a destination, and it’s one that can lead to greater financial independence and security throughout your life.

Best option