Introduction

In an era where people’s financial stability is gradually shifting into an unpredictable note, acquiring the skill of saving and mastering how to budget is more imperative than it has ever been. Regardless of your purpose to achieve long-term personal finance goals or simply trying to manage daily expenses, awareness of money management is very crucial.

The article will walk you through the basic fundamentals of budgeting, first and most importantly, the fundamental basics of budgeting, the initial and essential steps of creating an emergency fund, and practical strategies for boosting your savings each month. Here are some of the tools which will enable you to get out of this financial plight and be financially stable and secure. By taking control of your personal finances, you can reduce financial stress and build a more secure future

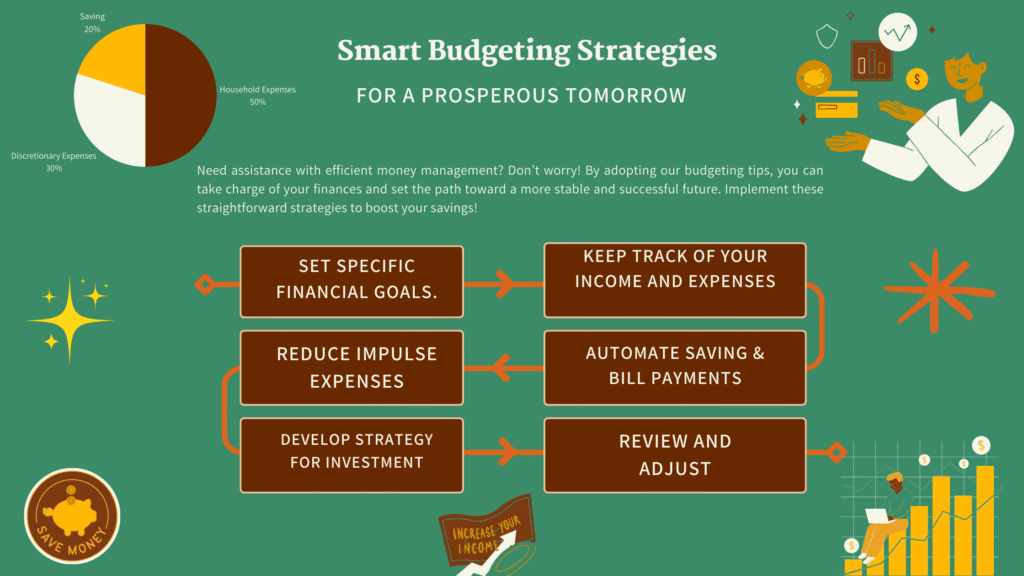

Budgeting: How to Craft & Maintain the Budget

Budgeting forms the base for any financial management plan. It is more than just recording your income and expenses; it is about consciously making an effort in the way you spend your money and align it with your financial goals and priorities. Understanding the essentials of effective budgeting is crucial for your financial well-being.

Steps to Create a Realistic Budget

Calculate Your Income: The first step in creating a realistic budget is calculating your monthly income. These are all the possible income that one has, to meet the expenses, whether from employment, freelancing, business, or property, among others. Having your exact income enables you to plan appropriately since it forms the foundation of your budgeting plan.

List Your Expenses: Segregate your monthly spending into subcategories. Your fixed expenses are those which remains constant in a particular time frame; these include rent or mortgage, utility bills, and loan repayments. Variable expenses, like groceries, entertainment, and transportation, may fluctuate and can often be adjusted. Don’t forget to include occasional or annual expenses such as car maintenance, holidays, or insurance premiums; spreading these costs over the entire year can prevent budget surprises.

Define Your Financial Objectives: Your budget should align with your financial goals. Whether saving for a vacation, clearing off debt, or building an emergency fund, clear goals help prioritize your spending. It is very essential to have a clear distinction between short-term goals (like saving for a new phone) and long-term goals (like buying a home or planning for retirement savings).

Allocate Your Income: Once you calculate your income and expenditure, next step is to allocate your income over the various expenditure heads. The 50/30/20 rule is a popular guideline: 50% of your income for necessities (such as housing, food, utilities), 30% for desires or luxury items (like dining out, hobbies, etc.), and 20% for saving and debt repayment. Alter these percentages to align with your unique financial objectives and situation.

Tips for Sticking to Your Budget

Use Budgeting Tools: Technology can assist to make budgeting easier. There are various tools that can help you track the expenses you incur. Apps like “Money Manager“, “MyMoney“, etc. may help you manage costs, classify spending, and even warn you when you’re about to reach your budget limit. Automation may be an effective tool for keeping your financial habits on track.

Conduct Regular Reviews: Your budget should be just as dynamic as your life. Analyse and adjust your budget on a regular basis or if significant financial changes occur, such as a raise or additional costs. Adjust your budget to ensures that it remains relevant and effective. If you spend too much money in one category, make up the difference by cutting back elsewhere. Over time, you’ll tweak your budget to better represent your lifestyle.

Maintain Consistency: Adhering to a budget demands focus and dedication. Avoid impulse purchases by delaying them—wait for at least 24 hours before buying anything non-essential and think. Focus on your goals and contemplate why you’re budgeting. Imagining your goals, such as a home you’re planning to buy or built and saving for, can strengthen your determination.

Distinguish Needs vs Wants: When creating your budget, it’s crucial to differentiate between essential needs and discretionary wants. This distinction will help you prioritize your spending and identify areas where you can potentially cut back to boost your budget savings.

Building an Emergency Fund: Why is it Significant and How is it Achieved

An emergency fund is money kept to be used in case of unpredictable emergencies like hospital bills, a broken-down car, or a slumped business, which can otherwise upset financial planning. An emergency fund acts as a cushion during such financial situations and is a crucial part of risk management.

Importance of an Emergency Fund:

Financial Security: Unforeseen circumstances are part and parcel of life, and it will not be wrong to say that most emergencies have financial implications. An emergency fund guarantees that you won’t have to use high-interest credit in rather adverse circumstances. It gives a sense of security that you would not compromise your investment plans regardless of business downturns.

Avoiding Debt: If one doesn’t have an emergency fund, in such scenario a sudden unexpected expense means that one has to borrow money which can lead to loans and debt. Having money put aside means you don’t have to borrow and then deal with the stress that comes with having to repay loans.

Flexibility: Money is a form of security that allows you to act according to your plans and needs, and not according to the available budget. For instance, getting time off because of an illness or waiting between employment are some of the benefits that can be afforded to confront lifetime adversities through an emergency fund.

Establishing an emergency fund not only offers peace of mind but also plays a critical role in managing financial stress. By knowing you’re prepared for unexpected expenses, you’re better equipped to stay calm and focused even during uncertain times.

Steps to Build an Emergency Fund

Define a Target Amount: It is advised that everyone should build an emergency fund that should be able to cover between three to six months’ worth of their current living expenses. This amount should be enough to offset your basic or fundamental needs of life like housing, food, clothing, fuel and power, and insurance. If your job is unstable or you’re self-employed, consider saving closer to six months. Start by calculating the basic expenses for any month and then multiply it by the decided number of months to get the target amount.

Start Small: Initially, building an emergency fund may be daunting, especially if you’re starting from scratch. Start with as small as 500 or 1,000, depending on what you are able and willing to save, then slowly increase as you gain the habit. Once you reach that milestone, continue building until you hit your target amount. By breaking milestones into smaller goals, the task becomes easier to accomplish the bigger goal in the long term.

Streamline Your Savings Process: The best practice in creating an emergency fund is to automate savings. Set aside a portion of your paycheck and deposit it directly into a savings account or open another checking account and link it to this one. This way, savings are treated as any other bill that has to be paid and hence gets priority.

Cut Back on Non-Essentials: To accelerate your savings, consider temporarily changing your spending habits, reducing discretionary spending, such as dining out less, cutting back on subscriptions, or choosing budget-friendly activities. This can free up extra cash to boost your emergency fund.

Where to Keep Emergency Fund: When deciding where to save money for your emergency fund, consider high-yield savings accounts or money market accounts that offer better interest rates while maintaining easy access to your funds.

Saving Strategies: Tips for Saving More Each Month

With the budget in place now and a growing emergency fund, the next step to be followed is to optimize your saving. Small consistent efforts can lead to significant financial rewards over time. Here are some money saving tips and saving ideas to help you save money fast, even on a low income.

Pay Yourself First: The principle of “paying yourself first” entails treating your savings like any other non-negotiable expense. There is no better approach to save money than depositing a certain amount of money you wish to save into your savings account before you start paying your bills or spending on other items you don’t need. This makes saving an intentional component and not something that is done in a haphazard manner. By automating this process, there is a high probability of eliminating the temptation to spend that amount elsewhere.

Reduce Discretionary Expenses: To reduce unnecessary expenses, you need to take a close look at where all your spending goes for a month and identify areas where you can cut back. This might mean eating out less, spending less on fun activities, or cutting down on shopping. Small changes, such as brewing coffee at home instead of purchasing it, or cancelling unwanted subscriptions, can add up over time. Redirecting these funds to your emergency fund or other financial goals can make a substantial difference.

Take Advantage of Discounts and Deals: Be a wise consumer by leveraging discounts, coupons, and cashback offers. These can help you save on every purchase. For big-ticket items, it’s better to wait for an appropriate event such as a sale and compare prices using price comparison websites to get the best offer. A penny saved is a penny that can be utilized in reaching your financial goals.

Avoid Lifestyle Inflation: Lifestyle inflation occurs when a person assumes a more substantial and extravagant way of living as soon as they get a better-paying job. It is, of course, healthy to feel that you are enjoying the rewards of a higher income, but it is equally important not to inflate your expenses to match the new income level. Rather, spend any extra amount of money that has been collected on saving, investing, or paying off your dues.

Prioritize Savings and Track Expenses: Make saving a priority in your financial plan. Set specific savings goals and work towards them consistently. Additionally, track your expenses meticulously to understand your spending patterns and identify areas where you can cut back. This financial discipline will help you make informed decisions about your money.

Explore Investment Options: While saving is crucial, don’t forget to explore various investment options for long-term financial growth. Consider diversifying your savings into different investment vehicles based on your risk tolerance and financial goals.

Conclusion

Managing finance, especially through budgeting and accumulation of money, is crucial in creating wealth. Ensuring that you set a budget and also follow it ensures that you are in control of your financial destiny, thus being able to achieve personal objectives. Having an emergency fund in place serves as a safety cushion for handling unexpected expenses without derailing your financial journey. Furthermore, successfully applied saving techniques mean you are getting the best out of your income while saving and becoming financially stable much faster.

Remember that wealth planning is not a lucky draw or done overnight; it is the consistent effort made over many weeks, months, or years. Embrace these principles of saving management and budgeting strategies today, and in the near future, everything will start to change gradually as far as your financial prospects are concerned. By following these money saving tips and focusing on the best way to save money, you’re taking significant steps towards financial independence and long-term financial well-being. Whether you’re looking for how to save money fast on a low income or simply want to improve your overall financial health, these strategies will help you build a solid foundation for a secure financial future.