In today’s fast-moving society, where one’s social media feeds are overflowed with curated pictures of luxury vacations, designer clothes, and lavish dining, etc. far too easily puts people into the lifestyle inflation trap. Lifestyle inflation, often disguised as “living your best life”—is a stealthy force that erodes financial freedom. But what is it, and why should one care? More importantly, how can you safeguard your financial future against its silent erosion?

Table of Contents

So what is Lifestyle Inflation?

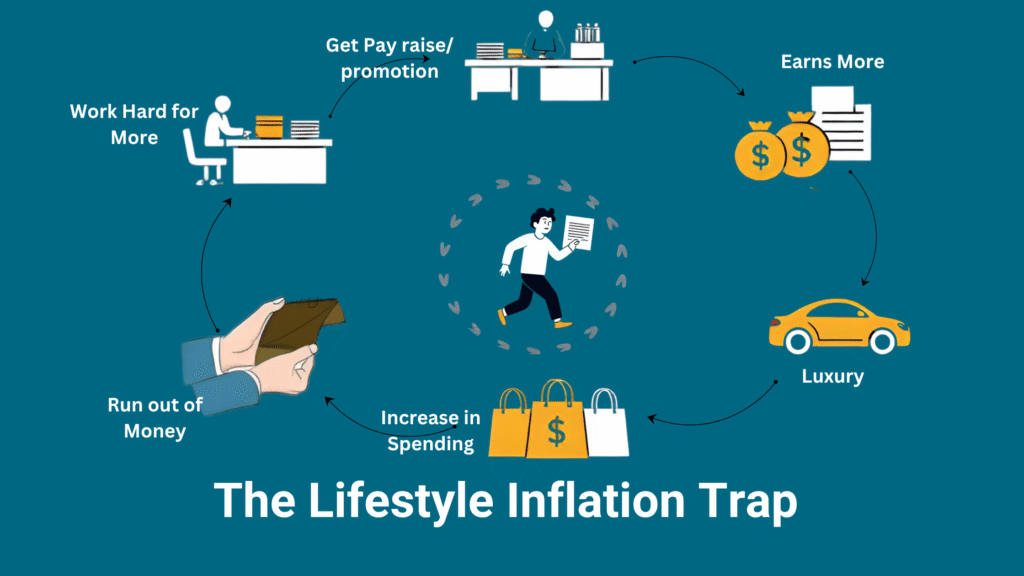

Lifestyle inflation, sometimes called lifestyle creep, is the gradual increase in spending that accompanies an increase in income. It is where individuals with increased income tend to upgrade their lifestyles, spending more on nicer cars, gadgets, dining out more, or pampering themselves with expensive hobbies. It’s normal to want nicer things or a better life when you have extra cash, but if you don’t keep an eye on it, this habit can stop you from saving or reaching your long-term financial goals.

At first glance, it may appear harmless; however, after some time, lifestyle inflation can have dire consequences on your financial capability. It’s like filling a bucket with a hole in it; no matter how much you pour in, it never gets full !

Key Takeaways

- Increased Income Leads to More Spending: As your income increases, it is natural to increase your spending too, often on things that are not necessary, which takes away from your savings and financial progress.

- Overspending Reduces Financial Flexibility: Overspending makes it hard to manage the unexpected expenses that arise, to build an emergency fund, or to save for future goals or invest for the long term.

- Budgeting and Automation can Prevent Lifestyle Inflation: Planning budgets, automating your savings, and putting specific, reasonable savings goals in place can help to insulate you against falling into the trap of lifestyle inflation.

- Prioritize Experiences Over Material Goods: Having meaningful experiences rather than material objects builds much more lasting happiness and is a way to curb your spending.

- Financial Literacy is Crucial: The better you are at understanding personal finance concepts around saving, investing, and managing debt, the more resistant you will be to lifestyle inflation.

- Small Decisions Have Long-term Impact: Simple decisions—saving part of your raise instead of upgrading your lifestyle, e.g.—can seriously affect your long-term financial security.

A Quick History of Spending Trends

Lifestyle inflation isn’t a new phenomenon. As society evolves, so do our spending habits. What was a considered luxury once is now may be seen as necessity. Remember when smartphones were a novelty? We can’t ever imagine our life without them now. The interesting thing is that as incomes increase our desires of fancier things also increases, making it a never-ending cycle of spending more to keep up the standard of living.

Early 20th Century: Mass production and advertising made people feel like buying more things was a sign of moving forward in life.

1980s: The expensive brands and luxury lifestyles became the order of the day. People believed they laboured hard, and therefore, they worked hard to spend their luxury items. To possess anything of value has been treated as a measure of success.

Early 21st Century: Instagram and TikTok offered an avenue for people to share pieces of their lives. But this is just a highlight reel, showing a selected few of the shiny positive moments of their lives. Now comparisons are an easy temptation that justifies our need to spend to keep up.

Understanding Lifestyle Inflation

Lifestyle inflation, also referred to as “lifestyle creep,” is a subtle issue that can jeopardize even the most solid financial strategy. People end up spending more as their income increases. This move could result in substantial financial difficulties.

Common Factors Causing Lifestyle Creep

Lifestyle creep can occur for a variety of causes, the most prevalent of which are:

- Pay increases or promotions

- Bonuses or unexpected financial gains

- Changes in social networks and peer influences

- Life milestones such as marriage, childbirth, or home ownership

- Normalization of Debt

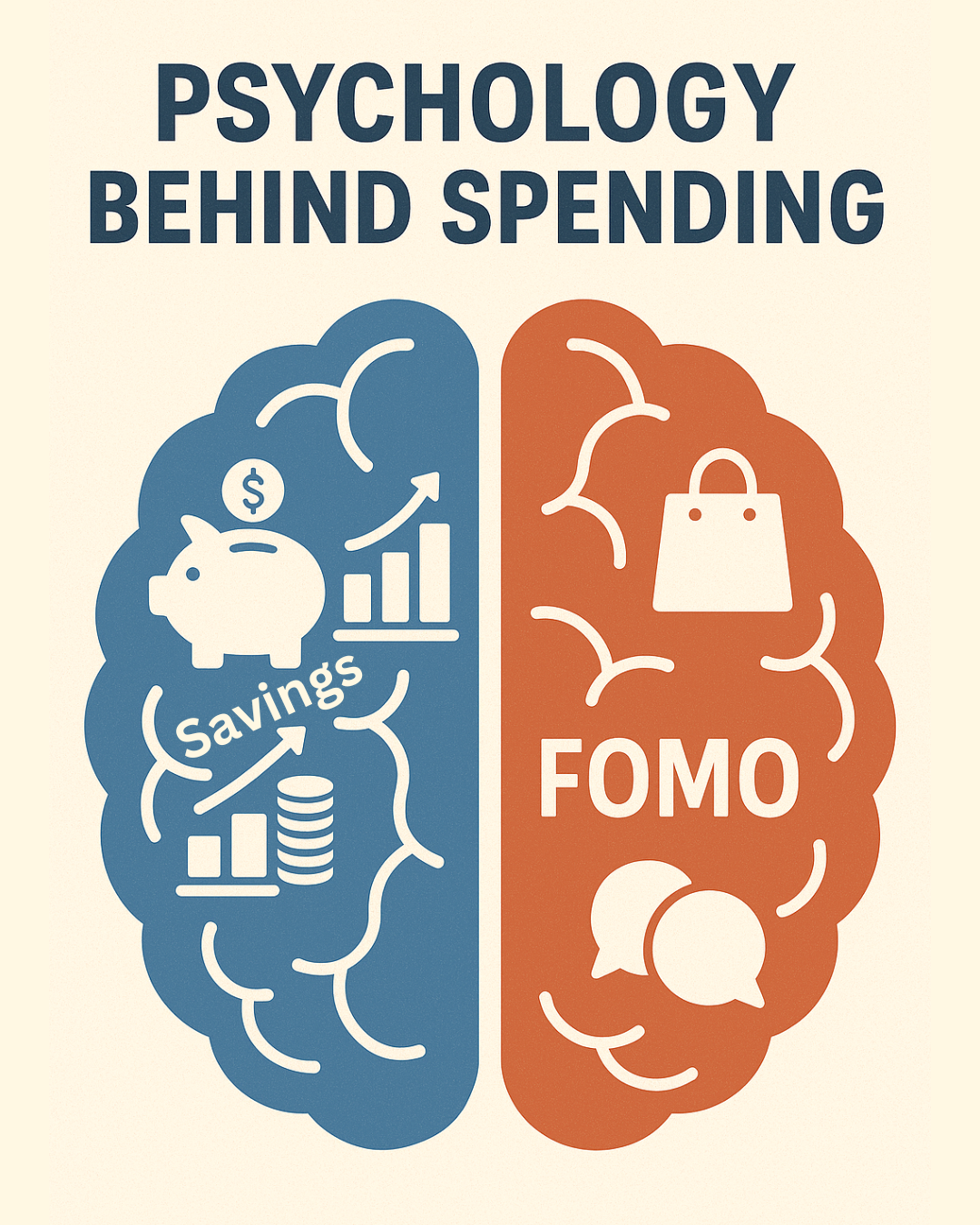

The Psychology Behind Increased Spending

Peer pressure, fear of missing out, and the desire for social prestige account for the majority of the spending increase. People may justify purchases as their income rises because they believe they “deserve” them or that they enhance their quality of life. We must identify and control these inclinations because these emotional triggers have the potential to undermine financial discipline and cause long-term failures.

Signs You’re Falling into the Lifestyle Inflation Trap

It’s important to catch lifestyle inflation early so it doesn’t mess up your financial plans. The more your earnings rise, the more you risk unconsciously spending larger amounts of money on things you had never needed before, which can hurt your savings and financial goals.

Early Warning Signs

- Purchasing bigger and fancier things such as car, gadgets or even house, etc, without having a proper financial plan.

- Allocating a notable amount of income to discretionary spending such as dining out, entertainments etc. while neglecting savings & Investment

- Feeling compelled to continuously update to latest trends or spending habits to match what others purchase or perform (peer pressure).

Spending Habits to Keep an Eye On

- Impulsive spending: That’s when you can’t resist the urge to grab the latest gadgets, trendy outfits, or luxury treats right away.

- Rationalization: Individuals frequently justify unnecessary expenditures by convincing themselves that they “deserve” such items or that these purchases will enhance their quality of life.

- Emotional spending: It refers to turning to shopping or splurging as a way to deal with stress, boredom, or any tough feelings.

Financial Red Flags

Lifestyle inflation often shows up in several financial warning signs, such as:

| Red Flag | Potential Consequence |

| Rising credit card debt | Accumulating high-interest debt and hurting your credit report |

| Declining savings rate | Risking your capacity to attain long-term financial objectives, including retirement or large purchases |

| Struggling to pay monthly expenses | Starting to rely on more debt or using emergency savings to pay for your simple living expenses. |

Consequences of Lifestyle Inflation:

Lifestyle inflation has a significant adverse impact on the health of our finances. Overspending reduces the likelihood that we can save. These choices can harm the long-term goals, such as retirement. Lifestyle inflation could also cause you to become more deeply in debt and less independent with your money.

| Metric | Impact of Lifestyle Inflation |

| Savings Rate | Lower saving ability for the future |

| Debt Level | Higher debt reliance to maintain standard of living |

| Financial Flexibility | Limited capacity to adapt to changes or emergencies |

| Anxiety | Being stressed about finance even with a high income |

| Missed Opportunities | Not having enough financial room for meaningful experiences, self-growth, or giving back |

| Investment Growth | Decreases availability of funds for investments, slowing down wealth creation and long-term financial growth |

| Work-Life Balance | Overworking because of pressure to maintain income levels can reduce quality of life |

Strategies to Combat Lifestyle Inflation

In order to fight lifestyle inflation, you need to create a solid financial plan. By adopting intentional habits and staying focused on your overall goals, you can you can lessen the chance of filling your days with unproductive activities that necessitate spending money, as well as develop financial security.

Here are some effective strategies to deal with lifestyle inflation:

Embrace Budgeting Discipline

Having a well-planned budget is necessary to manage your finance effectively. Monitor your income and every expense to understand where it is getting utilized. Set certain amount for necessities, savings, and discretionary and try to limit yourself within that.

Set Clear Financial Goals:

Defining concrete financial objectives can also help to discipline your discretionary expenditure, be it for saving to buy a house, saving for an emergency fund, or saving for retirement, having your goals at the back of your mind will discourage you from unnecessary expenditure.

Automate Savings and Investments

Make savings a priority by determining your savings or investment accounts and setting up an automatic transfer as soon as you receive your paycheck. This will help you fund your goals before you start spending money elsewhere.

Spend Mindfully

Before you make the purchase, ask yourself whether it aligns with your values and your long-term objectives. Avoid making impulse purchases by implementing a waiting period, for instance, 24 hours, for discretionary expenditures.

Prioritize Experiences Over Material Possessions

Studies indicates that experiences bring longer-term happiness compared to material possessions. Rather than spend on extravagances invest in meaningful experiences, such as traveling, learning, or spending time with loved ones and friends.

Limit Exposure to Consumer Culture

Reduce the influence of advertising and social media that have on you by unfollowing accounts which promote excessive consumerism. Instead focus on those content that inspires financial discipline which aligns with your goals.

Regularly Review Your Financial Progress

Keep an eye on your financial situation by reviewing it regularly. Adjust your budget and goals as needed to reflect any changes in your income, expenses, or priorities.

Resist Upgrading with Every Income Increase

Whenever you receive a raise, bonus, or windfall, avoid the urge to immediately upgrade your lifestyle. Save some part of the incremental income in savings, investments, or debt repayment, and spend only a fraction on discretionary goods and services.

Practice Gratitude:

Practicing gratitude makes you appreciate the possessions you already have, which reduces the desire for more. Make a conscious effort to appreciate the things you’re thankful for, and focus on non-materialistic means of happiness.

Living Large or Saving Smart? The Choice Is Yours

For a proper comprehension of lifestyle inflation, let’s take two scenarios:

Scenario 1: Sarah’s Story

Sarah is granted a 20 percent increment in her salary at her job. Instead of saving it, she refurnishes her apartment, buys a new car, and eats out more frequently. Over time she continues to spend at her new level with very little to save. When an unexpected medical bill arises, now she is no longer in a position to afford it.

Scenario 2: John’s Story

John receives a 20% raise in his salary. He saves 50% of that increase amount, invests 30%, and uses 20% on discretionary spending. By this John builds a stable financial foundation and reaches his long-term goals by living off on current lifestyle and saving.

These instances show that small decisions can have radically different results. If you’re careful and by being intentional with your spending, you can avoid the pitfalls of lifestyle inflation.

The Significance of Financial Literacy

Financial literacy is instrumental for helping you prevent lifestyle inflation that can easily creep up as your income grows. Through the acquisition of skills like saving, investing, and budgeting, you can acquire good money habits and gain more mastery of your finances. Knowing something about managing money will most likely make you prioritize your long-term financial security rather than spending promptly on short-term comforts. Schools, friends, and even your neighbourhood are wonderful sources to draw upon for financial education to develop your financial confidence. The more time you spend taking financial education, the more equipped you’ll become at making good financial choices to plan and develop a secure and stable future.

Conclusion:

Lifestyle inflation is a silent threat that can slowly erode your financial stability even before you realize it. While it’s human nature to want to reap the benefits of your hard work, you need to be careful about how you spend your newfound higher earnings. Spending consciously, defining financial goals and saving or investing can allow you to strike a healthy balance between enjoying today and securing it for tomorrow. Real financial freedom does not come from how much money you make; it comes on the skills of managing the little that reaches your hand. The choice is yours, live large today or build lasting wealth for tomorrow.

Take control of your finances today, and you’ll thank yourself tomorrow.