Financial stress has become a widespread challenge, impacting millions of people around the world. It’s often seen just as money issues, but it can also deeply affect our mental and emotional health. That’s why it is so important to recognize how serious it can be. The more we understand it, the better we can manage it and take better care of our overall well-being.

Introduction

The modern world, with its rapid pace and economic uncertainty, has made financial stress an unavoidable part of life for a vast majority of individuals. The burden of financial worries in the form of debt repayment problems, stagnant wages, and retirement savings troubles has a profound impact on individual mental wellbeing. Our attention typically fixates on immediate financial consequences, but we often neglect to consider psychological and emotional costs that accompanies with it.

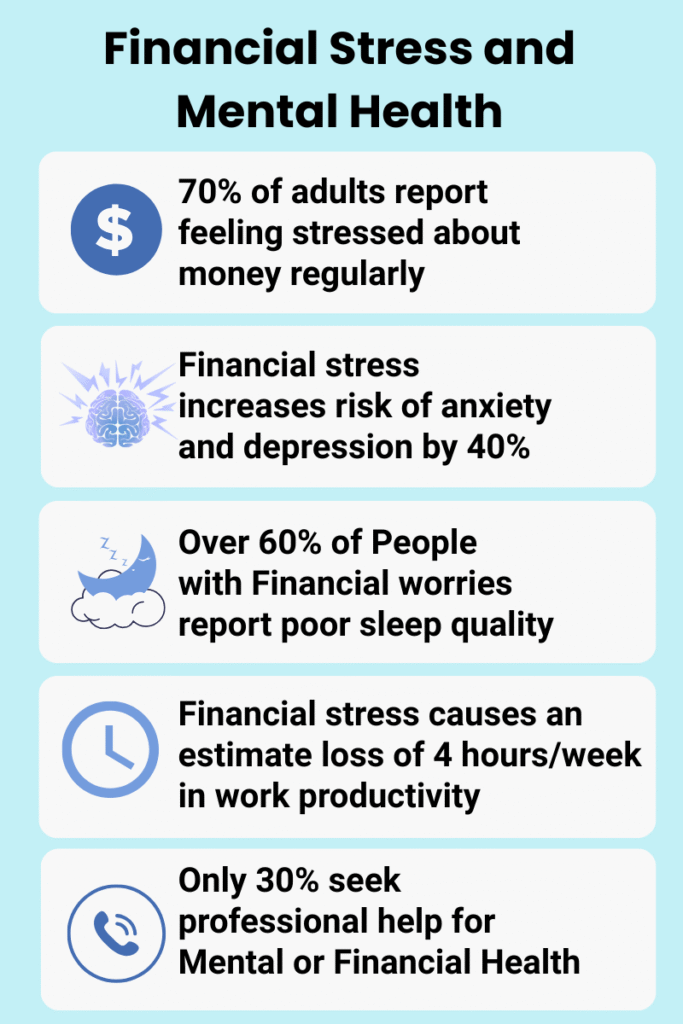

Financial stress in India arises from low financial literacy, rising cost, job insecurity and increasing debt levels. The American Psychological Association (APA) reports that 72% of Americans experienced financial stress at least once during the previous month, indicating an alarmingly high rate that demonstrates the strong link between financial insecurity and mental health problems (APA). This article examines the psychological, physical, and behavioural impacts of financial stress while providing practical strategies to maintain both financial stability and emotional health.

Table of Contents

Understanding Financial Stress and Its Triggers

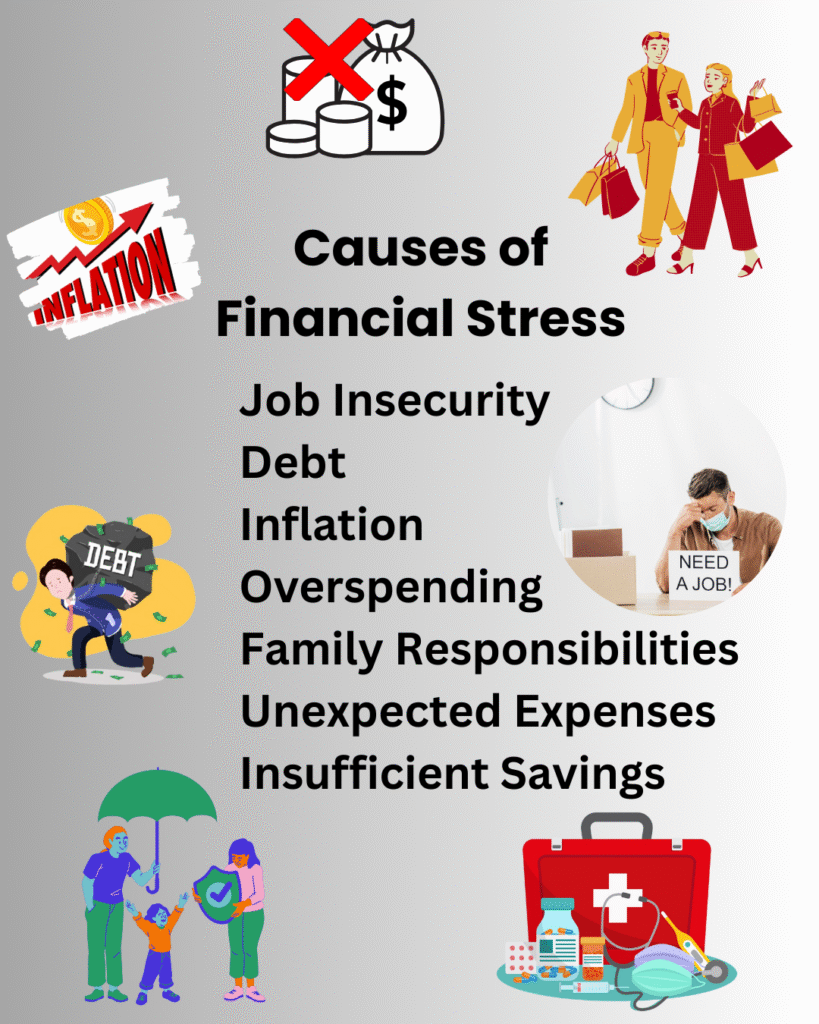

The term financial stress denotes the mental pressure individuals experience due to monetary problems. The phenomenon manifests when people perceive a deficit in financial means which prevents them from fulfilling fundamental necessities or pursuing personal aspirations. Stress emerges from financial difficulties beyond poverty affecting middle-class and wealthy people who face debt issues, investment downturns, or unsupportable living standards.

Common financial stressors include high levels of debt, employment uncertainty, and insufficient savings. Irregular and unstable income earners such as gig workers and freelancers are the most vulnerable to it. Added to all these are escalating living costs such as rent/mortgage payments, utilities, and medical bills are leading to the financial stress for many people today. The consequences of financial stress extend far beyond empty bank accounts; they have serious effects on individuals mental and emotional well-being.

Personal Finance and Emotional Wellness: A Two-Way Connection

Financial management isn’t just about numbers. It’s intertwined with our mental well-being. There is bi-directional relationship between personal finance and mental health.

Mental health is enhanced by learning about financial literacy and smart personal financial management. Having control over money leads to better emotional well-being. It also minimizes mental health issues like stress and anxiety.

Living in constant financial uncertainty affects the emotional state of people. Studies in the Journal of Public Health have shown individuals with higher levels of financial stress have much greater levels of psychological distress (NCBI). The constant concern about bills or the accumulation of debts causes a cycle of anxiety and makes it difficult to concentrate on the workplace or personal responsibilities.

Insecurity in finances will most likely lead to despair and hopelessness when individuals fail to see any way out. People who suffer from long-term financial stress may become emotionally detached or have mood swings and, in the process, strain their relationships and social connections even further.

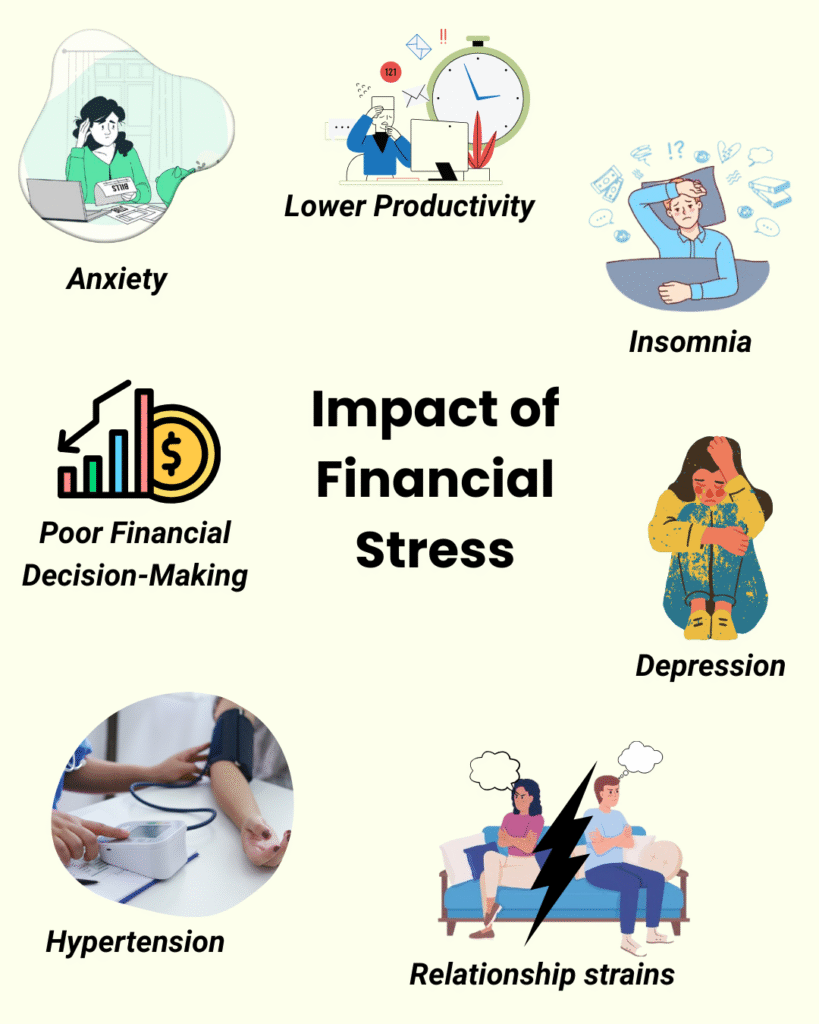

In addition, financial stress impairs cognitive functioning, including memory and decision-making skills. Chronically stressed individuals make irrational or impulsive financial decisions, such as overspending or delayed bill payments, and it further aggravates financial issues.

There is a need to break this cycle for a balance between personal finance management and mental health. Resolving the financial issues and cultivating healthy habits helps and gives more control and stability, which improves mental health and quality of life.

Physical Health Implications of Long-term Financial Stress

Financial stress affects both mental and physical health. Long term exposure to financial stress, activates production of stress hormones such as cortisol, which are detrimental to overall health. Financial stress is correlated with higher risks for chronic conditions including hypertension and heart disease.

Sleeping problems are another frequent result. Insomnia is common among people under financial stress, as they lie awake at night preoccupied with thoughts of their financial issues. Chronic sleep deprivation, over time, can cause fatigue, lower immunity, and poor concentration.

Aside from the mental tension, chronic stress can weaken the immune system and leave individuals susceptible to perpetual colds, the flu, and other illnesses. The sicknesses in the body and the mental tension create a vicious cycle of deteriorating health.

Behavioural and Social Impact of Financial Stress

Financial stress also manifests itself in behavioural and social interaction changes with long-term effects on personal health. People engage in unhealthy coping behaviours such as substance abuse, excessive eating, or shopping binges in the belief that they will get temporary relief. Such coping behaviours create further financial instability and create a self-reinforcing feedback loop.

For example, people in financial difficulties may use impulse shopping to cope with emotional distress. The temporary relief they experience does not last long and ends up aggravating the financial issues further.

Financial stress often impacts relationships. Money issues are the top reason for divorce and relationship breakdown. When money problems surface, they tend to break down the bond of trust, create resentment, and destroy emotional intimacy, and it becomes increasingly difficult for the couple to have healthy relationships with each other.

Also, financial stress can lead to social isolation. Individuals will avoid social outings or family gatherings so as not to spend money or talk about financial issues, and they will end up isolated and alone on an emotional level.

Financial Stress in the Workplace

Financial stress even carries over into the workplace and severely affects the productivity of employees. Money-strapped employees have lower levels of concentration, increased absenteeism, and lower morale. It is found through research that financially stressed employees will be prone to errors, miss deadlines, and be disconnected in the workplace.

Employers are now recognizing the importance of financial wellness programs for the benefit their employees. Organisations are offering financial counselling, debt management seminars, and employee assistance programs (EAPs) to help employees manage their financial stress.

By controlling financial stress in the workplace, employers can boost morale, reduce turnover, and enhance overall productivity of their employees.

Long Term Impact and Risks

Unchecked financial stress has the potential to develop into long-term mental health disorders including post-traumatic stress disorder (PTSD). People facing severe financial crises like bankruptcy or home foreclosure often develop PTSD symptoms including flashbacks, emotional numbness, and avoidance behaviours.

Chronic financial stress can even lead to cognitive decline in the long term. Studies show that long-term exposure to stress hormones can negatively impact memory and problem-solving ability, making an individual more susceptible to age-related cognitive disorders.

Financial difficulty also has a tendency to affect families and children, leading to a chain effect. Children growing up in financially insecure households are likely to feel emotional instability and development issues, observing their parents’ financial struggle.

Suggestions for Managing Financial Stress

Though financial strain may be daunting, proactive measures exist to enable individuals to regain control of their finances, as well as their mental well-being.

Create a Monthly Budget

One of the most effective ways of managing financial stress is the establishment of a realistic monthly budget. This involves tracking income and spending in order to prioritize the spending of essential items and identifying areas where spending can be reduced.

Build an Emergency Fund

Even small, regular contributions to an emergency fund can make you feel financially secure. Three to six months’ living expenses is what financial planners recommend you save to cover unforeseen costs.

Seek Professional Financial Advice

Consulting with a financial planner or counsellor can allow individuals to plan debt repayment timetables, improve money management skills, and set achievable financial objectives.

Prioritize Mental and Emotional Well-being

Beyond financial planning activities, maintaining mental health stands as a critical necessity. The deliberate practice of stress-reducing activities including yoga, meditation, exercise, and breathing techniques builds emotional resilience

Access Financial Wellness resources

In contemporary times numerous employers and community organizations provide complimentary financial wellness programs. Engaging with these services enables individuals to gain essential knowledge about managing debts while developing budgeting skills and financial planning strategies.

Conclusion: Building Financial Resilience for Better Overall Wellbeing

Financial stress is not merely a monetary challenge but a multifaceted issue with profound implications for mental, emotional, and physical well-being, as well as personal relationships. The path to overcoming its hidden costs lies in recognizing the inseparable link between financial health and mental resilience. By adopting proactive strategies such as stringent budgeting, debt elimination, and building emergency funds in tandem with prioritizing emotional self-care and seeking professional intervention, individuals can cultivate both financial stability and psychological toughness. This dual focus creates resilience, allowing individuals to navigate financial crises with confidence and clarity. Ultimately, the journey to wellness requires a balanced, holistic approach: addressing financial behaviours and mental health in tandem not only eliminates stress but also paves the way for enduring stability and a brighter, secure tomorrow.