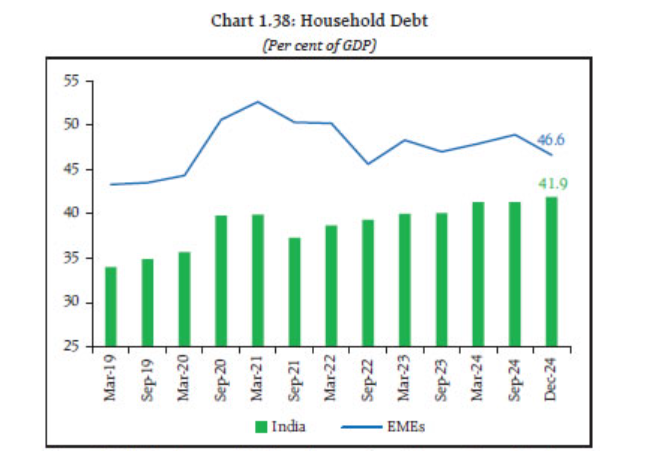

Credit cards, EMIs and personal loans are a way of life in India. On its surface, the lifestyle of middle-class may look glowing, but underneath lies a silent financial crisis. Growing debt is putting pressure on the wallets of millions of families, with nearly 45% of the middle-class households are spending more than 40% of their incomes on EMIs, and thus they have a very small amount left for the fulfilment of even the basic necessities. India’s households debt has soared to an unprecedented high of 48.6% of the GDP by March 2025, a significant leap from 32% in 2019 and 41.9% in December 2024.

The consequences are harsh: a lot of people delay the purchase of their own home, their savings capacity is limited, and their retirement period is uncertain. However, through the use of efficient methods and with a disciplined approach, it is possible to get out of this trap.

The Reality of India’s Middle-Class Debt Crisis

There are several reasons behind the rise in debt. Firstly, was the overindulgence of easy avenues of credit such as credit cards, Buy Now Pay Later (BNPL) schemes, and small personal loans, which allowed families to borrow more money than needed. Car, holidays, and mobile phone aspirations are the fuels of lifestyle inflation, although real wages are either stagnant or have increased by a small margin. To quote the Reserve Bank of India’s (RBI) Financial Stability Report (June 2025), the non-housing retail loan sector, which comprises credit cards and personal loans, accounts for 54.9% of the total household debt, has the quickest growth compared to housing loans and stands at 25.7% of the disposable income.

In addition to that, the per capita average debt has rose from ₹3.9 lakh in March 2023 to ₹4.8 lakh in March 2025, which is a 23% increase in just two years. This rise in debt has not been compensated for with the creation of assets; close to half of this has been accounted for consumption expenses rather than wealth-building, according to expert Saurabh Mukherjea. The middle-income groups borrowers are now resorting to the practice of getting multiple loans; credit cards, personal loans, and even gold loans, to the point where they are barely able to cover their everyday expenses and as a result, they are plunging 5-10% of India’s middle-class population into a debt spiral that is unsafe.

The volume of defaults and delinquencies is experiencing a rise. The percentage of loan defaults that have been overdue by more than 90 days touched 3.6% in March 2025, while credit card delinquencies went up to 7.6% in June 2024, thus highlighting that an increasing number of people are struggling with their finances. The following results in a situation that reflects rising household savings that are at their lowest historical level: continuous debt servicing is eating away the ability to save for one’s security or long-term objectives.

Signs You’re Trapped in the Debt Cycle

First of all, it is very important to understand that debt has not become a trap. The warning signs to look-out for are:

- Only making minimum monthly payments on credit cards

- Paying more than 40% of your salary towards EMIs

- Taking a loan to clear another, and thus juggling with different debts

- Not having a financial safety net to fall back on in case of shocking events

If these are familiar to you, they are a red flag that calls for an immediate action.

How Debt Affects Your Financial Future

The hang of debt on a person’s financial life is such that it also affects their emotional health and future security. Debt that becomes a habit will eventually lead to stress and anxiety, which in turn will lower the quality of life of the person. Financially, high-interest borrowing that is paid off late will take away the time that should have been used for wealth creation and retirement planning because of the missed compounding opportunities.

For instance, Mohan is a 28-year-old account executive who is paying EMIs that are almost equal to half of his ₹40,000 monthly salary. Consequently, his ever-decreasing budget has no space at all for savings and he is forced to make compromises that hinder the fruition of his future plans. Likewise, the savings of the middle class have come down to their lowest point of the last 50 years, which is around 5.3% of the GDP, thus indicating a disappearing financial buffer.

Moreover, a high level of debt has an adverse effect on a person’s credit score and eventually leads to higher borrowing costs in the future and puts a ceiling on the availability of low-interest loans.

Steps to Break Free: Climbing Out of Debt

Face Your Numbers

Start with a complete rundown of your liabilities: the amount, the interest rate, and the due date. Whether you go digital with tools like CRED or INDmoney, or use your trusty old Excel sheet, the goal is to have a clear picture of your debts and to chart a way to pay them back.

Prioritize Debt Repayment

Decide on a method that will not only suit your finances but will also match your mind:

Avalanche method: Focus on the loans with the highest interest rate first. The rest can go down quickly due to the lessening of the total interest.

Snowball method: Eliminate the smallest debts first to acquire energy to continue.

To illustrate, a credit card with a ₹50,000 limit and 36% interest will turn into a monstrous debt very quickly if left unattended. On the other hand, working on this one debt first will make a huge amount of your money last-term.

Cut Lifestyle Inflation

Reevaluate your spending by properly categorizing your needs and wants. Lower your subscription rates, stop buying expensive items, and reduce your EMI for non-necessary products. Financial experts warn that 40% out of all the smartphones purchased in India are bought on EMI, these are some of the main reasons why families get caught up in the debt cycle which is not sustainable.

Negotiate & Consolidate

Talk to your lenders, ask for lower interest rates or balance transfers. It is better to merge your multiple high-interest loans into a single one which is a personal loan with a lower-interest rate, hence you can both simplify your finances and save money.

Build an Emergency Fund (Even While in Debt)

The goal is to have a small emergency fund of ₹20,000 to ₹50,000 to meet the unexpected situations. This safety net is preventing one from borrowing more in case the unexpected expense arises.

Seek Professional Help if Overwhelmed

If you have many loans and are feeling overwhelmed, take the help of experts. You may use credit counselling or debt management programs. Professionals can assist you in negotiating with creditors the restructuring of your repayments and, they can give you financial education.

Preventing Future Debt Traps

If you want to stay away from falling into the debt trap again:

The EMI plan of not more than 40% monthly income is what you should follow. That means your monthly EMIs should not take up more than 40% of your income.

Lifestyle creep can be prevented if you focus on budget, goals and make conscious effort to save some part of the incremental income.

Make it a habit to save and invest automatically so that building wealth becomes your priority.

Either start a side business or use systematic investment plans (SIP) to create multiple income streams.

The Bottom line

The trend clearly highlights a shift in consumer behaviour, the Indian middle class is now moving away from cautious spending patterns and embracing a more aspirational lifestyle. However, much of this expense growth is being financed through credit, leading to a sharp rise in household debt levels.

The dreams of the middle class of India do not always have to be crushed under the heavy and increasing burden of debt. The trend can be modified by early debt tackling, through strategic planning. Being honest about one’s debt and using structured repayment schemes like avalanche or snowball and cutting down on lifestyle inflation can help attain financial freedom. The virtuous cycle that leads to freedom from EMI trap can be initiated today by creating a list of debts and deciding on a repayment method. Along with this focus on financial education and savings & investments to generate wealth.